5. Can I return to work while receiving short term disability for mental health?

Yes, many people return to work while still receiving disability benefits for mental health issues, especially when their health shows signs of improvement. This is often done on a part-time basis initially, or by availing of workplace modifications, depending upon the individual’s recovery process and capabilities.

However, it’s important to bear in mind that returning to work could potentially affect your disability benefits, depending on the terms of your insurance policy. Consult with your disability insurance provider and mental health professionals to ensure a smooth transition back into work while maintaining necessary support.

Securing short-term disability benefits for mental health is possible, but requires careful steps. One must begin with a consultation with a healthcare provider to obtain a diagnosis. Subsequent steps involve getting necessary documentation detailing the severity of your condition from the healthcare provider, and filing a claim with your disability insurance provider. It’s crucial to remember that the approval for such claims depends on thorough and credible documentation of your mental health condition.

The road to obtaining short-term disability can be arduous, but it’s vital to persevere for your well-being. If your claim is denied initially, don’t lose hope. Consider enlisting the help of a disability lawyer or an advocate to assist you in the follow-up process. Remember, taking care of your mental health is a priority, and seeking assistance to do so is a powerful step forward.

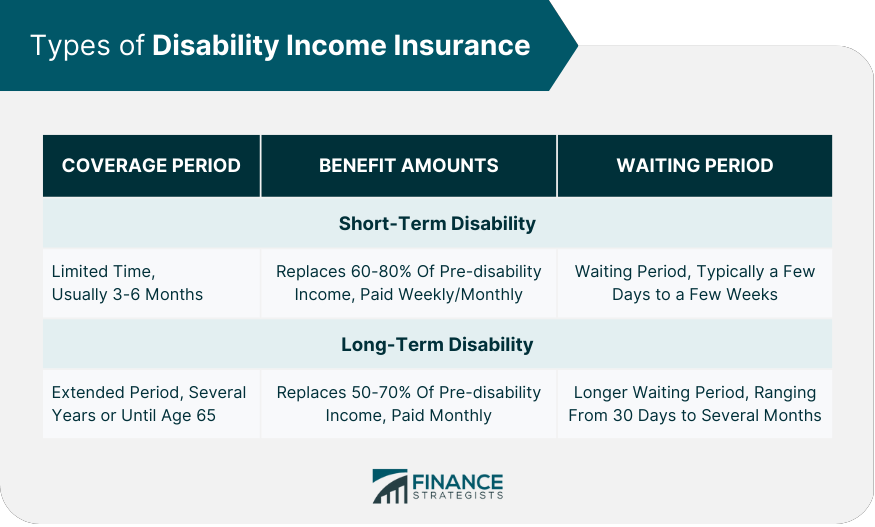

The length of time you can receive benefits for short term disability due to mental health will depend on the specifics of your insurance policy. Most short term disability policies provide benefits for between 3-6 months, although this can vary. Some policies might limit the duration of benefits for mental health-related disabilities.

Make sure to thoroughly understand your policy’s terms and limitations. If your disability is expected to last longer than the term of your short term disability policy, consider transitioning to long term disability insurance if available and applicable.

5. Can I return to work while receiving short term disability for mental health?

Yes, many people return to work while still receiving disability benefits for mental health issues, especially when their health shows signs of improvement. This is often done on a part-time basis initially, or by availing of workplace modifications, depending upon the individual’s recovery process and capabilities.

However, it’s important to bear in mind that returning to work could potentially affect your disability benefits, depending on the terms of your insurance policy. Consult with your disability insurance provider and mental health professionals to ensure a smooth transition back into work while maintaining necessary support.

Securing short-term disability benefits for mental health is possible, but requires careful steps. One must begin with a consultation with a healthcare provider to obtain a diagnosis. Subsequent steps involve getting necessary documentation detailing the severity of your condition from the healthcare provider, and filing a claim with your disability insurance provider. It’s crucial to remember that the approval for such claims depends on thorough and credible documentation of your mental health condition.

The road to obtaining short-term disability can be arduous, but it’s vital to persevere for your well-being. If your claim is denied initially, don’t lose hope. Consider enlisting the help of a disability lawyer or an advocate to assist you in the follow-up process. Remember, taking care of your mental health is a priority, and seeking assistance to do so is a powerful step forward.

The length of time you can receive benefits for short term disability due to mental health will depend on the specifics of your insurance policy. Most short term disability policies provide benefits for between 3-6 months, although this can vary. Some policies might limit the duration of benefits for mental health-related disabilities.

Make sure to thoroughly understand your policy’s terms and limitations. If your disability is expected to last longer than the term of your short term disability policy, consider transitioning to long term disability insurance if available and applicable.

5. Can I return to work while receiving short term disability for mental health?

Yes, many people return to work while still receiving disability benefits for mental health issues, especially when their health shows signs of improvement. This is often done on a part-time basis initially, or by availing of workplace modifications, depending upon the individual’s recovery process and capabilities.

However, it’s important to bear in mind that returning to work could potentially affect your disability benefits, depending on the terms of your insurance policy. Consult with your disability insurance provider and mental health professionals to ensure a smooth transition back into work while maintaining necessary support.

Securing short-term disability benefits for mental health is possible, but requires careful steps. One must begin with a consultation with a healthcare provider to obtain a diagnosis. Subsequent steps involve getting necessary documentation detailing the severity of your condition from the healthcare provider, and filing a claim with your disability insurance provider. It’s crucial to remember that the approval for such claims depends on thorough and credible documentation of your mental health condition.

The road to obtaining short-term disability can be arduous, but it’s vital to persevere for your well-being. If your claim is denied initially, don’t lose hope. Consider enlisting the help of a disability lawyer or an advocate to assist you in the follow-up process. Remember, taking care of your mental health is a priority, and seeking assistance to do so is a powerful step forward.

In the event of a denial, employers must provide a reason along with information on how to appeal the decision. An unjust or suspicious denial of your claim could potentially be a case of bad faith. Consult a lawyer specializing in disability insurance if you face trouble during this process.

4. How long can I receive short term disability for mental health?

The length of time you can receive benefits for short term disability due to mental health will depend on the specifics of your insurance policy. Most short term disability policies provide benefits for between 3-6 months, although this can vary. Some policies might limit the duration of benefits for mental health-related disabilities.

Make sure to thoroughly understand your policy’s terms and limitations. If your disability is expected to last longer than the term of your short term disability policy, consider transitioning to long term disability insurance if available and applicable.

5. Can I return to work while receiving short term disability for mental health?

Yes, many people return to work while still receiving disability benefits for mental health issues, especially when their health shows signs of improvement. This is often done on a part-time basis initially, or by availing of workplace modifications, depending upon the individual’s recovery process and capabilities.

However, it’s important to bear in mind that returning to work could potentially affect your disability benefits, depending on the terms of your insurance policy. Consult with your disability insurance provider and mental health professionals to ensure a smooth transition back into work while maintaining necessary support.

Securing short-term disability benefits for mental health is possible, but requires careful steps. One must begin with a consultation with a healthcare provider to obtain a diagnosis. Subsequent steps involve getting necessary documentation detailing the severity of your condition from the healthcare provider, and filing a claim with your disability insurance provider. It’s crucial to remember that the approval for such claims depends on thorough and credible documentation of your mental health condition.

The road to obtaining short-term disability can be arduous, but it’s vital to persevere for your well-being. If your claim is denied initially, don’t lose hope. Consider enlisting the help of a disability lawyer or an advocate to assist you in the follow-up process. Remember, taking care of your mental health is a priority, and seeking assistance to do so is a powerful step forward.

Employers typically cannot deny your short term disability claim for mental health if you meet the disability definition under the policy, and they have received all requested documentation. They must process your claim in good faith and according to the terms of the disability insurance policy.

In the event of a denial, employers must provide a reason along with information on how to appeal the decision. An unjust or suspicious denial of your claim could potentially be a case of bad faith. Consult a lawyer specializing in disability insurance if you face trouble during this process.

4. How long can I receive short term disability for mental health?

The length of time you can receive benefits for short term disability due to mental health will depend on the specifics of your insurance policy. Most short term disability policies provide benefits for between 3-6 months, although this can vary. Some policies might limit the duration of benefits for mental health-related disabilities.

Make sure to thoroughly understand your policy’s terms and limitations. If your disability is expected to last longer than the term of your short term disability policy, consider transitioning to long term disability insurance if available and applicable.

5. Can I return to work while receiving short term disability for mental health?

Yes, many people return to work while still receiving disability benefits for mental health issues, especially when their health shows signs of improvement. This is often done on a part-time basis initially, or by availing of workplace modifications, depending upon the individual’s recovery process and capabilities.

However, it’s important to bear in mind that returning to work could potentially affect your disability benefits, depending on the terms of your insurance policy. Consult with your disability insurance provider and mental health professionals to ensure a smooth transition back into work while maintaining necessary support.

Securing short-term disability benefits for mental health is possible, but requires careful steps. One must begin with a consultation with a healthcare provider to obtain a diagnosis. Subsequent steps involve getting necessary documentation detailing the severity of your condition from the healthcare provider, and filing a claim with your disability insurance provider. It’s crucial to remember that the approval for such claims depends on thorough and credible documentation of your mental health condition.

The road to obtaining short-term disability can be arduous, but it’s vital to persevere for your well-being. If your claim is denied initially, don’t lose hope. Consider enlisting the help of a disability lawyer or an advocate to assist you in the follow-up process. Remember, taking care of your mental health is a priority, and seeking assistance to do so is a powerful step forward.

Employers typically cannot deny your short term disability claim for mental health if you meet the disability definition under the policy, and they have received all requested documentation. They must process your claim in good faith and according to the terms of the disability insurance policy.

In the event of a denial, employers must provide a reason along with information on how to appeal the decision. An unjust or suspicious denial of your claim could potentially be a case of bad faith. Consult a lawyer specializing in disability insurance if you face trouble during this process.

4. How long can I receive short term disability for mental health?

The length of time you can receive benefits for short term disability due to mental health will depend on the specifics of your insurance policy. Most short term disability policies provide benefits for between 3-6 months, although this can vary. Some policies might limit the duration of benefits for mental health-related disabilities.

Make sure to thoroughly understand your policy’s terms and limitations. If your disability is expected to last longer than the term of your short term disability policy, consider transitioning to long term disability insurance if available and applicable.

5. Can I return to work while receiving short term disability for mental health?

Yes, many people return to work while still receiving disability benefits for mental health issues, especially when their health shows signs of improvement. This is often done on a part-time basis initially, or by availing of workplace modifications, depending upon the individual’s recovery process and capabilities.

However, it’s important to bear in mind that returning to work could potentially affect your disability benefits, depending on the terms of your insurance policy. Consult with your disability insurance provider and mental health professionals to ensure a smooth transition back into work while maintaining necessary support.

Securing short-term disability benefits for mental health is possible, but requires careful steps. One must begin with a consultation with a healthcare provider to obtain a diagnosis. Subsequent steps involve getting necessary documentation detailing the severity of your condition from the healthcare provider, and filing a claim with your disability insurance provider. It’s crucial to remember that the approval for such claims depends on thorough and credible documentation of your mental health condition.

The road to obtaining short-term disability can be arduous, but it’s vital to persevere for your well-being. If your claim is denied initially, don’t lose hope. Consider enlisting the help of a disability lawyer or an advocate to assist you in the follow-up process. Remember, taking care of your mental health is a priority, and seeking assistance to do so is a powerful step forward.

The process for claiming a short term disability for mental health broadly involves three steps. First, a comprehensive medical examination from a certified mental health professional is necessary, followed by the submission of a formal claim to the insurance company. The insurance company then reviews the claim.

The documentation must include a diagnosis, the treatment plan, and a clear indication of how the mental health condition limits your ability to work. Keep in mind, the insurance company may require additional information or seek a second opinion before they approve the claim. Once the claim is approved, the benefits generally begin after a waiting period stipulated in the policy.

3. Can an employer deny my short term disability for mental health?

Employers typically cannot deny your short term disability claim for mental health if you meet the disability definition under the policy, and they have received all requested documentation. They must process your claim in good faith and according to the terms of the disability insurance policy.

In the event of a denial, employers must provide a reason along with information on how to appeal the decision. An unjust or suspicious denial of your claim could potentially be a case of bad faith. Consult a lawyer specializing in disability insurance if you face trouble during this process.

4. How long can I receive short term disability for mental health?

The length of time you can receive benefits for short term disability due to mental health will depend on the specifics of your insurance policy. Most short term disability policies provide benefits for between 3-6 months, although this can vary. Some policies might limit the duration of benefits for mental health-related disabilities.

Make sure to thoroughly understand your policy’s terms and limitations. If your disability is expected to last longer than the term of your short term disability policy, consider transitioning to long term disability insurance if available and applicable.

5. Can I return to work while receiving short term disability for mental health?

Yes, many people return to work while still receiving disability benefits for mental health issues, especially when their health shows signs of improvement. This is often done on a part-time basis initially, or by availing of workplace modifications, depending upon the individual’s recovery process and capabilities.

However, it’s important to bear in mind that returning to work could potentially affect your disability benefits, depending on the terms of your insurance policy. Consult with your disability insurance provider and mental health professionals to ensure a smooth transition back into work while maintaining necessary support.

Securing short-term disability benefits for mental health is possible, but requires careful steps. One must begin with a consultation with a healthcare provider to obtain a diagnosis. Subsequent steps involve getting necessary documentation detailing the severity of your condition from the healthcare provider, and filing a claim with your disability insurance provider. It’s crucial to remember that the approval for such claims depends on thorough and credible documentation of your mental health condition.

The road to obtaining short-term disability can be arduous, but it’s vital to persevere for your well-being. If your claim is denied initially, don’t lose hope. Consider enlisting the help of a disability lawyer or an advocate to assist you in the follow-up process. Remember, taking care of your mental health is a priority, and seeking assistance to do so is a powerful step forward.

Short term disability for mental health encompasses a wide range of conditions that impair a person’s thinking, feeling, behavior, or mood. These may involve conditions like anxiety, depression, bipolar disorder, schizophrenia, post-traumatic stress disorder (PTSD) or other similar psychiatric disorders. However, any mental health condition’s recognition for short term disability depends upon the severity of its impact on the person’s ability to work.

A certified mental health professional like a psychiatrist must provide a diagnosis and detailed treatment plan, showcasing the level of the individual’s functional impairment. Remember – not all mental health conditions will qualify for disability benefits, so consulting with an experienced disability insurance attorney may be beneficial.

2. How is a short term disability claim for mental health conditions processed?

The process for claiming a short term disability for mental health broadly involves three steps. First, a comprehensive medical examination from a certified mental health professional is necessary, followed by the submission of a formal claim to the insurance company. The insurance company then reviews the claim.

The documentation must include a diagnosis, the treatment plan, and a clear indication of how the mental health condition limits your ability to work. Keep in mind, the insurance company may require additional information or seek a second opinion before they approve the claim. Once the claim is approved, the benefits generally begin after a waiting period stipulated in the policy.

3. Can an employer deny my short term disability for mental health?

Employers typically cannot deny your short term disability claim for mental health if you meet the disability definition under the policy, and they have received all requested documentation. They must process your claim in good faith and according to the terms of the disability insurance policy.

In the event of a denial, employers must provide a reason along with information on how to appeal the decision. An unjust or suspicious denial of your claim could potentially be a case of bad faith. Consult a lawyer specializing in disability insurance if you face trouble during this process.

4. How long can I receive short term disability for mental health?

The length of time you can receive benefits for short term disability due to mental health will depend on the specifics of your insurance policy. Most short term disability policies provide benefits for between 3-6 months, although this can vary. Some policies might limit the duration of benefits for mental health-related disabilities.

Make sure to thoroughly understand your policy’s terms and limitations. If your disability is expected to last longer than the term of your short term disability policy, consider transitioning to long term disability insurance if available and applicable.

5. Can I return to work while receiving short term disability for mental health?

Yes, many people return to work while still receiving disability benefits for mental health issues, especially when their health shows signs of improvement. This is often done on a part-time basis initially, or by availing of workplace modifications, depending upon the individual’s recovery process and capabilities.

However, it’s important to bear in mind that returning to work could potentially affect your disability benefits, depending on the terms of your insurance policy. Consult with your disability insurance provider and mental health professionals to ensure a smooth transition back into work while maintaining necessary support.

Securing short-term disability benefits for mental health is possible, but requires careful steps. One must begin with a consultation with a healthcare provider to obtain a diagnosis. Subsequent steps involve getting necessary documentation detailing the severity of your condition from the healthcare provider, and filing a claim with your disability insurance provider. It’s crucial to remember that the approval for such claims depends on thorough and credible documentation of your mental health condition.

The road to obtaining short-term disability can be arduous, but it’s vital to persevere for your well-being. If your claim is denied initially, don’t lose hope. Consider enlisting the help of a disability lawyer or an advocate to assist you in the follow-up process. Remember, taking care of your mental health is a priority, and seeking assistance to do so is a powerful step forward.

Securing short term disability for mental health issues isn’t common knowledge, though one in five U.S. adults experience mental illness each year. Unfortunately, the lack of awareness tends to discourage many from seeking the necessary intervention and support.

Acquiring short term disability for mental health warrants clear understanding of insurance policies and legal stipulations. For instance, the Disability Benefits Law in New York provides eligible employees with 50-60% of their average weekly earnings for up to 26 weeks. Thus, navigating the intricacies can lead to substantial financial reprieve during tough times.

- Establish the presence of a mental health condition diagnosed by a healthcare professional.

- Check the specific policy conditions of your short-term disability insurance.

- Obtain necessary documentation from your physician detailing how your condition impedes your work ability.

- Submit disability claim form along with the required documents to your insurance provider.

- Follow up regularly until you receive feedback regarding the status of your claim.

Is Anxiety a Valid Cause for Short Term Disability Benefits?

Anxiety disorders are among the most common mental health conditions faced by a considerable populace worldwide. They can interfere significantly with daily activities, making them a valid reason for short term disability. If you’re experiencing severe anxiety, it’s essential to understand that you may be entitled to short term disability benefits. It is noteworthy that the intensity of the psychological distress you are experiencing qualifies it as a disability.

Short term disability for mental health, like anxiety, is usually provided when the mental distress is severe enough to prevent you from fulfilling your employment duties effectively for a certain duration. To obtain these benefits, a diagnosis must typically be provided by a licensed healthcare professional specifying the nature and severity of your condition. If you have been dealing with anxiety and its effects on your life and work, don’t hesitate to seek help and inquire about your eligibility for short term disability benefits.

How to Navigate Work Interruptions Due to Mental Health Challenges?

Experiencing mental health challenges can often result in periods where work becomes difficult, if not impossible. The pressing question thus becomes, how can one access short-term disability coverage for mental health? Short-term disability coverage comes into play here as a significant lifeline. It’s a type of insurance that pays a percentage of an employee’s salary for a specified amount of time, if they are ill or injured, and cannot perform the duties of their job. When it comes to mental health, this coverage can be vital in affording individuals the time they need to recover without the added stress of financial insecurity.

Typically, to obtain this type of coverage for mental health, you would need to provide diagnostic information from a licensed mental health professional that clearly states you are unable to complete your work tasks due to your conditions. Furthermore, the specifics of how to apply can vary substantially depending upon one’s employer, the state you live in, and the specifics of the insurance policy. Therefore, a crucial first step is to contact your Human Resources department or insurance provider to get precise directions on where to start. In understanding this, it becomes evident that obtaining short-term disability coverage for mental health is not only possible, but crucial for those unable to work due to mental illness.

How Can You Assist a Person with Mental Health Issues Who Refuses Help?

Mental health, long been a topic of stigmatization, has caused many individuals to reject help in fear of being labeled. There are different forms of mental health disorders, ranging from anxiety and mood disorders to psychotic disorders like schizophrenia. Depending on the severity of the condition, individuals may or may not realize they need help and, unfortunately, this often makes it difficult for loved ones to intervene. When it comes to assisting an individual refusing help with their mental health, your approach can significantly impact the outcome.

Short-term disability for mental health can be defined as temporary benefits received by individuals unable to work due to mental health issues, which could range from generalized anxiety disorder to post-traumatic stress disorder. The benefits usually amount to a percentage of the person’s regular income and aims to provide financial support during their recovery period. It is crucial to keep in mind that qualifying for short-term disability due to mental health issues may require documentation from a healthcare provider as proof of need.

Understanding the Process: How Difficult is it to Acquire Mental Disability Status?

In the terminology of the healthcare system, mental disability refers to a wide range of mental health conditions that affects thinking, behavior, emotion, or mood. These conditions may include depression, anxiety disorders, schizophrenia, eating disorders, and addictive behaviors. Mental disabilities can potentially interfere with a person’s daily life and routine and might require special accommodations or treatment.

Securing short-term disability for mental health conditions isn’t straightforward as it might seem. There are several steps involved, from diagnosing the condition by a qualified healthcare professional to providing accurate documentation and proof for your claim. Remember, the requirements for obtaining disability benefits can vary across different jurisdictions. Thus, it is always advisable to consult with a legal or medical professional who is familiar with these processes to guide you adequately.

Navigating the Process of Acquiring Short Term Disability for Mental Health: A Comprehensive Guide

When it comes to the realm of mental health, it’s crucial to recognize that disorders can significantly affect an individual’s ability to function in their daily life, including their employment. Short term disability benefits can provide a lifeline in these situations, offering financial assistance during periods when one is unable to work due to their mental health conditions. However, the process of acquiring these benefits can be complex and daunting. This guide aims to provide clear and concise information on how to navigate this process successfully.

Short term disability benefits are designed to cover a portion of an individual’s salary when they are unable to work due to a physical or mental health disorder. The duration of these benefits varies, typically ranging from a few weeks to a year, depending on the policy and the severity of the condition. To qualify for these benefits, one must typically provide medical documentation of their condition and demonstrate that it interferes with their ability to perform their job effectively. The process can be intricate, requiring various forms and potentially necessitating the involvement of healthcare professionals. Therefore, understanding the steps involved in applying for short term disability benefits for mental health can be vital for those in need of these resources.

Is Short-Term Disability Coverage Available for Mental Health Conditions?

Short-term disability insurance is designed to provide workers with a portion of their income when they are unable to work due to a medical issue. This includes both physical and mental health conditions. However, the specifics of what is covered can vary depending on the terms of the insurance policy. Mental health conditions, such as depression, anxiety, and post-traumatic stress disorder, are often included in these policies. However, the insurer may require proof of the condition, such as a diagnosis from a licensed mental health professional.

Getting short-term disability for mental health involves a few key steps. Firstly, you need to check your policy or speak with your insurance provider to understand the specifics of your coverage. You’ll need to provide medical documentation to support your claim, which typically involves a diagnosis and treatment plan from a licensed mental health professional. You may also need to demonstrate that the condition is severe enough to prevent you from working. It’s important to remember that each insurance company and policy can have different requirements and processes, so it’s crucial to understand these details before beginning a claim.

Understanding the Process: How to Secure Approval for Short-term Disability Benefits for Anxiety and Depression?

Short-term disability benefits can provide a financial lifeline for individuals who are unable to work because of mental health conditions such as anxiety and depression. However, securing approval for these benefits can often seem like a daunting task. Understanding the process and requirements can help demystify this task and improve your chances of approval.

The first step in getting short-term disability for mental health conditions like anxiety and depression involves having a licensed healthcare professional diagnose your condition. This diagnosis must confirm that your mental health condition is severe enough to prevent you from performing your regular work duties. Additionally, you must have paid into the disability insurance program, usually through your employer, to be eligible for these benefits. It’s also important to understand that each disability insurance program may have different criteria for approval and duration of benefits. Hence, it’s best to consult with a professional or do thorough research to understand what applies to your specific situation.

How to Secure Sedgwick Short-Term Disability for Mental Health: A Comprehensive Guide

Short-term disability, provided by Sedgwick, is a type of insurance that pays a percentage of an employee’s salary for a specified amount of time, if they are ill or injured, and cannot perform the duties of their job. Coverage usually starts anywhere from one to 14 days after your employee suffers a condition that leaves them unable to work. It can be paid by either employer or employee, but most commonly, short-term disability is provided by employers. The term of this type of insurance policy varies, but it typically covers an individual for periods spanning from a few months to a year.

When it comes to mental health, the importance of such coverage cannot be overstated. Mental health issues are among the leading causes of disability worldwide, impacting millions of people each year. Sedgwick short-term disability insurance recognizes the impact of mental health conditions and provides coverage for individuals who are unable to work due to a wide range of mental health issues, including but not limited to, depression, anxiety, and bipolar disorder. The process to secure this coverage typically involves having a licensed healthcare provider certify the presence of a mental health condition and the need for time off from work. This certification, along with a completed claim form, is submitted to Sedgwick for review and approval.

How Can You Access Short-Term Disability for Mental Health in California?

In the state of California, short-term disability (STD) benefits are accessible to individuals who are unable to work due to a physical or mental health issue. This includes a range of mental health conditions such as anxiety, depression, or post-traumatic stress disorder. The California State Disability Insurance (SDI) program provides these benefits, including a portion of the income you would typically earn if you weren’t unable to work due to your mental health condition.

To access short-term disability for mental health, you need to follow a specific process. The first step entails obtaining a diagnosis from a medical professional who can substantiate your mental health condition. Following this, you must file a disability claim with the California Employment Development Department (EDD). The EDD reviews your claim, taking into account your medical evaluation and employment history, before making a decision on your eligibility. The benefits you receive are typically a percentage of your regular earnings, meant to provide financial support during your recovery period.

A Comprehensive Guide: How Can You Qualify for Short-Term Disability Because of Stress?

Short-term disability (STD) insurance is a policy that covers a portion of an employee’s income for a short period of time, typically between 2 weeks and 6 months. STD is generally used when you can’t work due to a medical condition, including mental health conditions such as stress. To qualify for STD due to stress, you must typically have a diagnosed mental health condition causing severe stress that affects your ability to work. This diagnosis often needs to be made by a licensed psychiatrist or psychologist.

The benefits of acquiring short-term disability for stress are substantial. It can provide financial security during a challenging time, allowing the individual to focus on recovery rather than financial stress. It also acknowledges the impact of severe stress on an individual’s work performance, reinforcing the importance of mental health in the workplace. However, it’s important to understand your specific policy’s rules and requirements, as not all policies cover mental health conditions. It’s recommended to consult with a trusted insurance professional or legal advisor to understand your rights and the process of applying for short-term disability for stress.

Can You Access Short-Term Disability for Mental Health through MetLife?

Securing a short-term disability for mental health issues can be a vital step towards ensuring financial stability while you focus on your well-being. MetLife, a leading provider of insurance products, offers short-term disability insurance that can cover mental health conditions. This coverage can provide you with a percentage of your regular income while you are unable to work due to a mental health condition.

Applying for short-term disability through MetLife generally involves a process of documentation and review. It’s crucial to have detailed medical records that clearly state your mental health condition and explain how it impacts your ability to perform your job. Once your claim is approved, you may be eligible to receive benefits for a specified duration, usually a few months, until you can return to work. Understanding the specifics of your MetLife policy, including any limitations or exclusions related to mental health, can help you navigate the process more effectively.

How to Access The Hartford Short-Term Disability for Mental Health?

The Hartford, a renowned insurance company, offers a short-term disability plan that covers mental health issues. This is a boon for individuals who may be unable to work due to mental health conditions. Short-term disability insurance is designed to replace a portion of your income during the initial weeks of a disabling illness or after an accident. This insurance coverage acknowledges that mental health is just as crucial as physical health and provides financial support during difficult times.

Obtaining The Hartford Short-Term Disability for mental health involves a few steps. Firstly, an individual must have a diagnosed mental health condition from a licensed healthcare professional. The diagnosis must indicate that the individual is unable to perform the essential duties of their occupation due to their mental health condition. Secondly, the individual must apply for the coverage, providing all necessary medical documentation. The insurance company will review the application and, if approved, the individual will be eligible to receive a percentage of their regular income while they are unable to work.

New York Life® Insurance – What is Short Term Disability – What is Disability Benefit”,”navigationEndpoint”:{“clickTrackingParams”:”CLACEJHeChgcIhMIu-_f3pa0hAMVkFJMCB1ZvgYh”,”loggingUrls”:[{“baseUrl”:”https://www.youtube.com/pagead/paralleladinteraction?ai=CtLR9aZjRZas77Lyfzw_Ty474AQCn4Jv88w8AEAEgAGDJBoIBE3BhcnRuZXIteW91dHViZS1zcnCoAwSqBBdP0Hd8ihwOseBMHy6g0TnsPSxaAdEaLpAHBKgH552xAqgH6J2xAqgHhAjSCCEIgEEQARheMgKCAjoEgEKAQEjZoNI1UBRYyP_g3pa0hAOwCwG6CzsIAxAFGAwgCygFMAVAAUgAWGpgAGgAcAGIAQCQAQGYAQGiAQgKAKgCAdgCAqgBAcABAdABAeABAYACAaAXAQ\u0026sigh=MRuztGnpvlQ\u0026cid=CAASFeRo8cvpgi8sVi4J_F8CQGO4ueTNCg\u0026ad_mt=[AD_MT]\u0026acvw=[VIEWABILITY]\u0026gv=[GOOGLE_VIEWABILITY]\u0026nb=%5BNB%5D\u0026label=video_click_to_advertiser_site

Key Takeaways

- Understand the eligibility requirements for short term disability benefits.

- Consult with a licensed mental health professional.

- File a claim with detailed medical records proving mental health condition.

- Keep communication open with your employer and insurance company.

- Aim to follow a therapeutic plan to improve your mental health condition.

Frequently Asked Questions

Understanding the process and eligibility for short term disability due to mental health can often be overwhelming. Here we have summarised the answers to some of the most commonly asked questions:

1. What qualifies as a mental health condition for short term disability?

Short term disability for mental health encompasses a wide range of conditions that impair a person’s thinking, feeling, behavior, or mood. These may involve conditions like anxiety, depression, bipolar disorder, schizophrenia, post-traumatic stress disorder (PTSD) or other similar psychiatric disorders. However, any mental health condition’s recognition for short term disability depends upon the severity of its impact on the person’s ability to work.

A certified mental health professional like a psychiatrist must provide a diagnosis and detailed treatment plan, showcasing the level of the individual’s functional impairment. Remember – not all mental health conditions will qualify for disability benefits, so consulting with an experienced disability insurance attorney may be beneficial.

2. How is a short term disability claim for mental health conditions processed?

The process for claiming a short term disability for mental health broadly involves three steps. First, a comprehensive medical examination from a certified mental health professional is necessary, followed by the submission of a formal claim to the insurance company. The insurance company then reviews the claim.

The documentation must include a diagnosis, the treatment plan, and a clear indication of how the mental health condition limits your ability to work. Keep in mind, the insurance company may require additional information or seek a second opinion before they approve the claim. Once the claim is approved, the benefits generally begin after a waiting period stipulated in the policy.

3. Can an employer deny my short term disability for mental health?

Employers typically cannot deny your short term disability claim for mental health if you meet the disability definition under the policy, and they have received all requested documentation. They must process your claim in good faith and according to the terms of the disability insurance policy.

In the event of a denial, employers must provide a reason along with information on how to appeal the decision. An unjust or suspicious denial of your claim could potentially be a case of bad faith. Consult a lawyer specializing in disability insurance if you face trouble during this process.

4. How long can I receive short term disability for mental health?

The length of time you can receive benefits for short term disability due to mental health will depend on the specifics of your insurance policy. Most short term disability policies provide benefits for between 3-6 months, although this can vary. Some policies might limit the duration of benefits for mental health-related disabilities.

Make sure to thoroughly understand your policy’s terms and limitations. If your disability is expected to last longer than the term of your short term disability policy, consider transitioning to long term disability insurance if available and applicable.

5. Can I return to work while receiving short term disability for mental health?

Yes, many people return to work while still receiving disability benefits for mental health issues, especially when their health shows signs of improvement. This is often done on a part-time basis initially, or by availing of workplace modifications, depending upon the individual’s recovery process and capabilities.

However, it’s important to bear in mind that returning to work could potentially affect your disability benefits, depending on the terms of your insurance policy. Consult with your disability insurance provider and mental health professionals to ensure a smooth transition back into work while maintaining necessary support.

Securing short-term disability benefits for mental health is possible, but requires careful steps. One must begin with a consultation with a healthcare provider to obtain a diagnosis. Subsequent steps involve getting necessary documentation detailing the severity of your condition from the healthcare provider, and filing a claim with your disability insurance provider. It’s crucial to remember that the approval for such claims depends on thorough and credible documentation of your mental health condition.

The road to obtaining short-term disability can be arduous, but it’s vital to persevere for your well-being. If your claim is denied initially, don’t lose hope. Consider enlisting the help of a disability lawyer or an advocate to assist you in the follow-up process. Remember, taking care of your mental health is a priority, and seeking assistance to do so is a powerful step forward.